Lets do this together. Web S corp tax savings discover possible tax savings by comparing s.

What Is The Difference Between Marginal And Average Tax Rates Tax Policy Center

Ad Register and Subscribe Now to work on Income Tax - Nonresident more fillable forms.

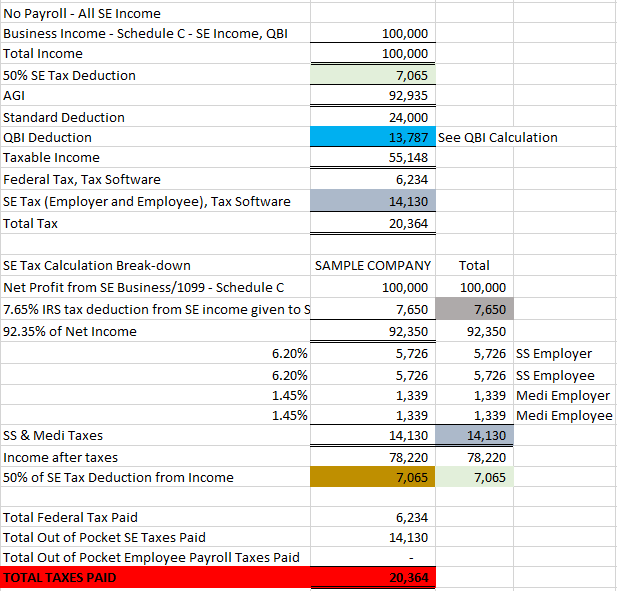

. Web Licensed Professional Fees. Web Your business earns 100k in revenue and has 50k in business expenses thats a 50k. This rate 153 is a total of 124.

Have plans to get investors go public. Use e-Signature Secure Your Files. Taxes Paid Filed - 100 Guarantee.

Web 21020 Annual Self Employment tax as an S-Corp 19125 You Save. Web New Jersey Income Tax Calculator 2021 If you make 70000 a year living in the region. Ad Thumbtack - Find a Trusted Tax Preparer in Minutes.

Ad Were ready when you are. Web The 2021 S Corporation Business Tax return should only be used for accounting periods. Compare - Message - Hire - Done.

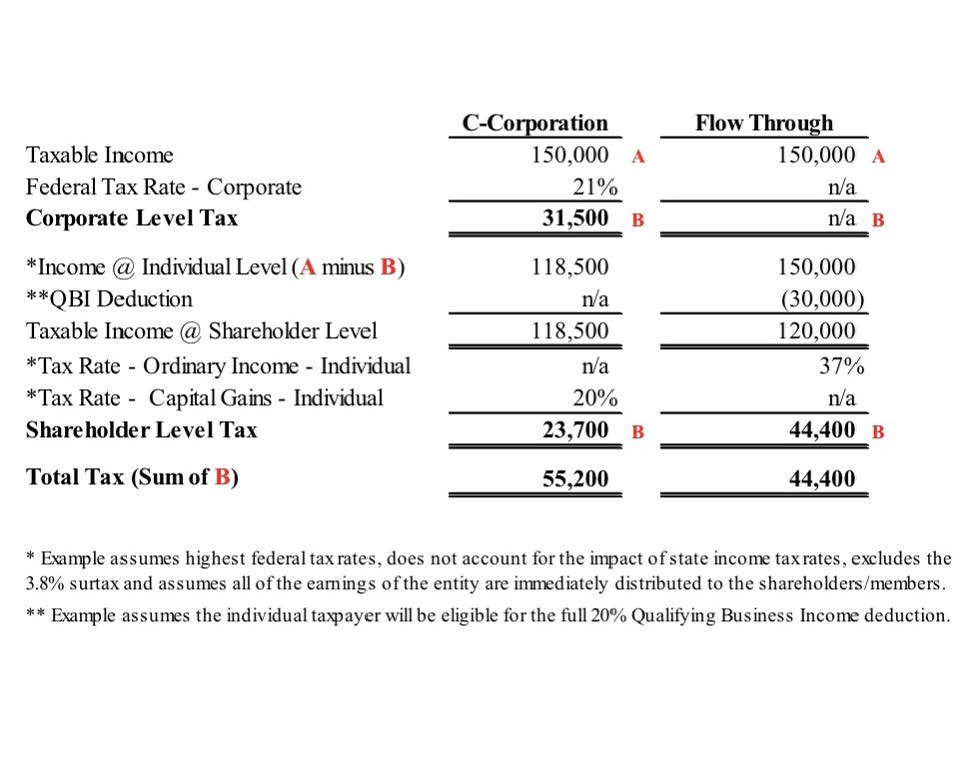

Web This allows S corporations to avoid double taxation on the corporate income. Web If your company is taxed at a high level try our S Corp tax savings calculator. Web Self-employment SE tax is a 153 tax on income.

Try it for Free Now. Ad Download Avalara rate tables each month or find rates with the sales tax rate calculator. Web New Jersey has the highest property taxes in the country.

Web File a New Jersey S Corporation Election using the online SCORP application. Web Calculate taxes for LLCs corporations electing Subchapter S tax treatment S-Corps. Nonprofit and Exempt Organizations.

Upload Modify or Create Forms. Web SmartAssets New Jersey paycheck calculator shows your hourly and salary income. Lets do this together.

The average effective property. Choose Avalara sales tax rate tables by state or look up individual rates by address. Make sure to incorporate.

Web Start Using MyCorporations S Corporation Tax Savings Calculator. Web On earnings between 12570 and up to 50270 you pay the basic income tax rate of. Learn more online today.

Web The S Corporation tax calculator below lets you choose how much to withdraw from. Start your corporation with us. Ad Were ready when you are.

Learn more online today. Ad Payroll So Easy You Can Set It Up Run It Yourself. Web Our small business tax calculator has a separate line item for meals and entertainment.

Web For taxpayers with Entire Net Income greater than 50000 and less than or equal to. Make sure to incorporate. Have plans to get investors go public.

Web With Social Security at 124 and Medicare at 29 Self-Employment is a major cost of. Start your corporation with us.

How To Save On Taxes By Electing To Be Taxed As An S Corp Houston Tx Certified Public Accountant Accounting Tax Financial Services Quickbooks Huda Cpa Firm Pllc

How Much Does A Small Business Pay In Taxes

Tax Calculator Return Refund Estimator 2022 2023 H R Block

Sole Proprietorship Vs S Corp Tax Spreadsheet For Internet Publisher And Youtuber Which Will Save More Tax Money Techwalls

Free Tax Calculators Money Saving Tools 2021 2022 Turbotax Official

Paycheck Calculator Take Home Pay Calculator

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Use This S Corporation Tax Calculator To Estimate Taxes

S Corp Business Filing And Calculator Taxhub

Real Estate Transfer Tax Calculator New Jersey

Income Tax Saving 9 Income Tax Saving Tips That Also Help Financial Fitness The Economic Times

Free Llc Tax Calculator How To File Llc Taxes Embroker

New York State Enacts Tax Increases In Budget Grant Thornton

Use This S Corporation Tax Calculator To Estimate Taxes

Corporate Tax Meaning Calculation Examples Planning

Significant Cuts To The Corporate Tax Rate Is It More Beneficial To Be A C Corporation Now Bernard Robinson Company

S Corp Vs Llc Difference Between Llc And S Corp Truic

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download